Customs Clearance Services at Birmingham Airport

Birmingham Airport, the UK’s third-largest, serves as a gateway to the West Midlands Region. Handling over 12 million passengers annually, the airport is well-equipped for global cargo operations.

Birmingham Airport benefits from a strong network of international connections, with direct flights to over 140 destinations worldwide. The airport is also located right next to the East Midlands Rail Link, allowing for more efficient transportation of goods and materials both domestically and internationally.

Birmingham Airport Customs Clearance:

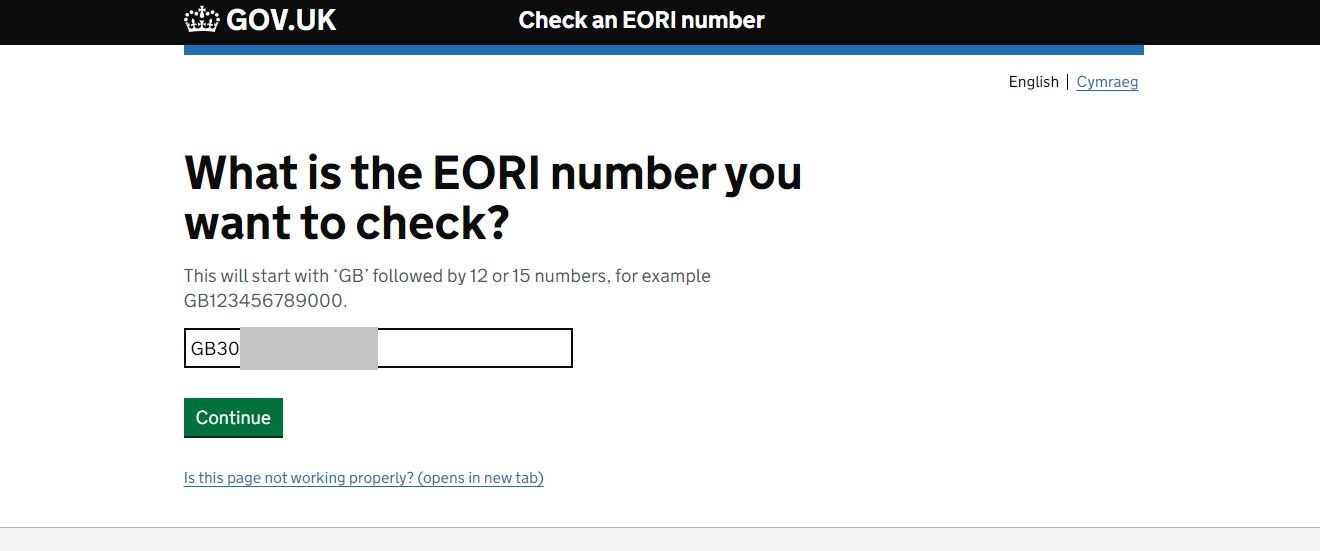

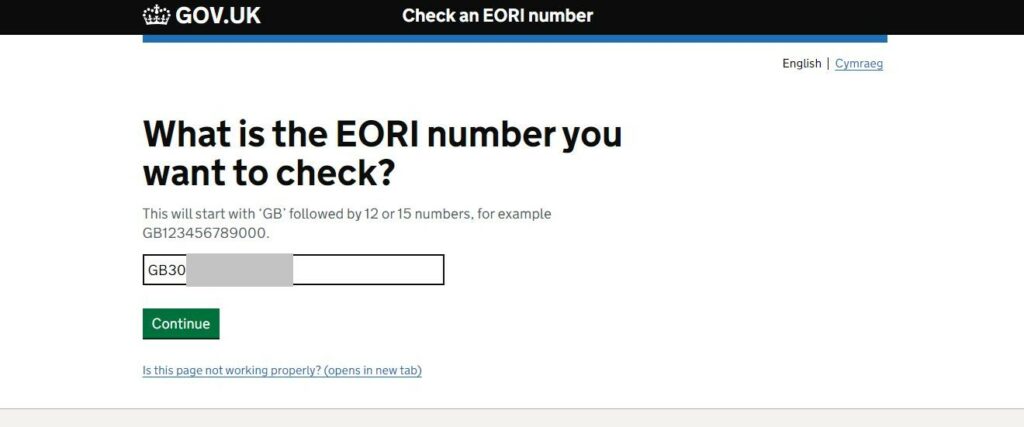

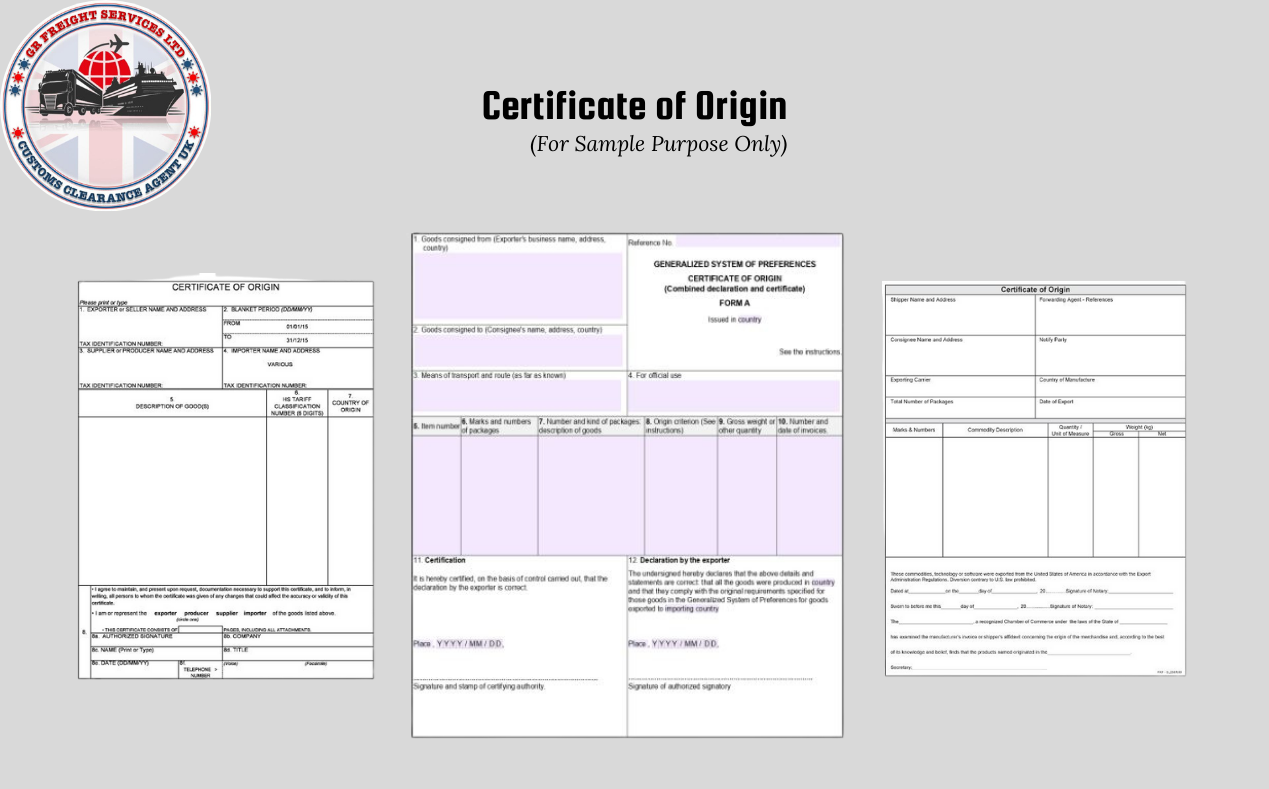

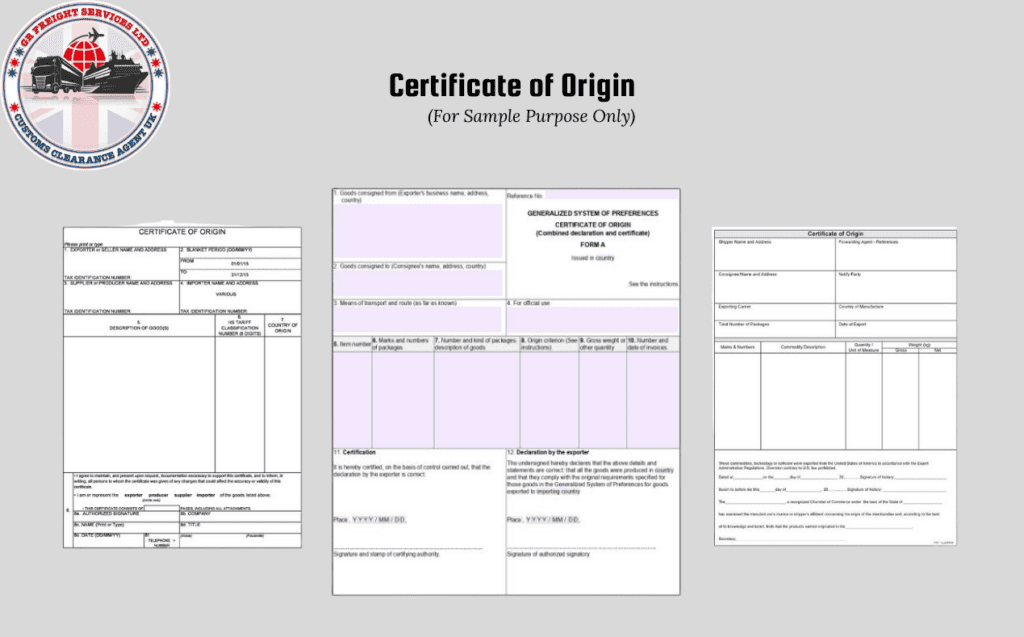

When engaging in cross-border trade, the significance of comprehensive customs clearance services cannot be overstated. Birmingham Airport offers a superlative, tailored service catering to businesses of all sizes. But these kind of services can be complex and require expert knowledge.

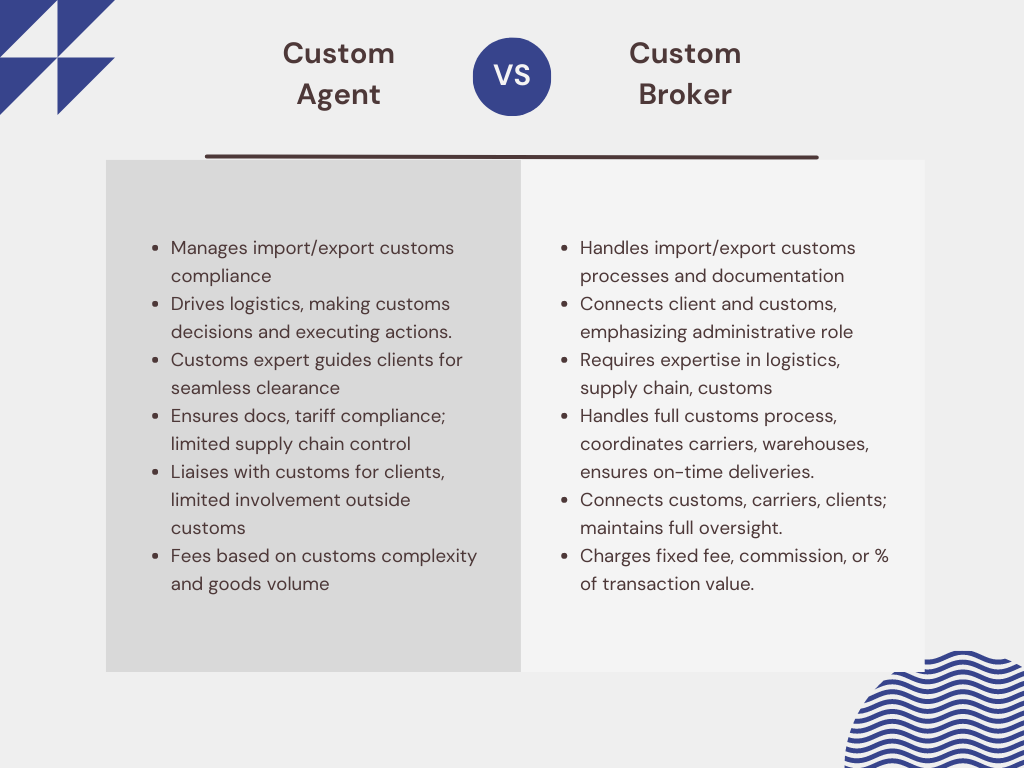

At GR Freight Services, we understand the complexities of global trading and customs clearance. Our team of experienced customs agents and brokers are committed to helping you navigate the rules and regulations so that your shipment is cleared quickly and efficiently.

We will work with you to create a custom clearance plan that meets all of your needs, from the paperwork to getting the goods where they need to be. With our help, you can relax knowing that your goods will make it through customs without any delays.

How much time does it takes for custom clearance at Birmingham Airport?

When it comes to custom clearance, the time required for the process hinges on a range of factors. These include the nature of the goods being imported or exported, the countries of origin and destination, and other pertinent considerations. In a general context, the majority of customs clearance procedures can be finalized within a matter of hours. It’s important to note that the team at GR Freight Services stands ready to furnish you with an estimated timeframe for your specific clearance procedure. This estimation will be tailored to the particulars you provide, ensuring a clear and accurate projection of the clearance process.

How much custom broker charge at Birmingham Airport?

The cost of customs clearance at Birmingham Airport varies based on factors like goods type and quantity. GR Freight Services offers competitive rates for customs clearance, ensuring you a fair price.

Is door-to-door cargo delivery possible after customs clearance?

Yes, you can! GR Freight Services offers door-to-door cargo delivery services for cleared goods. Our staff will coordinate all of the logistics so that your shipment arrives safely and on time.

Contact us:

If you have any questions about custom clearance at Birmingham Airport, please don’t hesitate to reach out. Our team of agents and brokers is here to answer all of your questions and make sure that everything goes smoothly with your shipment. Contact us today for more information about our customs clearing services!

Recent Blog

-

Importing Snails to the United Kingdom: A Guide for Individuals and Businesses

-

Say Goodbye to Customs Clearance Hassles with Tilbury's Professional Solutions

-

ATA Carnets Explained: Understanding the Basics and Benefits

-

Understanding EUR1 and EUR-MED Certificates: A Comprehensive Guide

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide