Pakistan to UK: Your Guide to Mango Import

Summer brings back the beloved mangoes, reigning supreme with their vibrant colors and irresistible aroma. These luscious fruits not only tantalize taste buds but also signify carefree sunny days ahead. In the United Kingdom, mangoes are consumed by 40% – 60% of households during summer, showcasing their popularity and versatility in sweet and savory dishes.

Importing Mangoes to UK from Pakistan:

Pakistan is a major player in the global mango market, known for producing over 1.9 million tons of mangoes annually. Its mangoes have gained popularity worldwide, especially in the United Kingdom, where 32% of imported mangoes come from Pakistan, making it the second-largest importer after the UAE.

Choose the type

When considering the import of mangoes from Pakistan, several options await your selection. The choices encompass renowned varieties like Chaunsa or Anwar Ratol, celebrated for their sweet and succulent flesh. Alternatively, if a tangier taste is more to your liking, you can explore Sindhri and Dussehri mangoes.

Find Reliable Suppliers

The success of your mango import business hinges on the quality and reliability of your suppliers. Seek out well-established Pakistani exporters with a track record of delivering high-quality mangoes. You’ll want to work with suppliers who can cater to the UK’s import regulations, including providing the necessary documentation and adhering to specific standards.

Consider attending trade shows and networking events to connect with potential suppliers face-to-face. If that’s not feasible, utilize online platforms or engage with trade associations to discover trusted contacts. Always ensure that you personally vet and build relationships with suppliers to establish a solid foundation for your business.

Imports Law

When engaging in an import business, possessing knowledge about the laws and regulations surrounding mango imports in the UK is paramount. According to the UK Government, it is possible to import mangoes into the country without obtaining a plant health certificate.

However, it is advisable to consult with us regarding import laws and regulations before taking any steps. Ensuring compliance with all rules and requirements is crucial. Failure to adhere to these laws may lead to substantial fines or even a ban on imports. Therefore, staying updated and well-informed is indispensable.

Understand Shipping Logistics

Shipping logistics is an integral part of any import business, and it’s no different when it comes to mangoes. You’ll need to plan well in advance for the shipping process, taking into account factors like transportation, storage, and handling. Consult with your suppliers about their preferred methods of shipping and collaborate with them to ensure timely delivery.

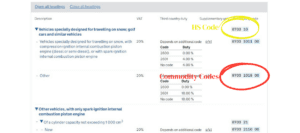

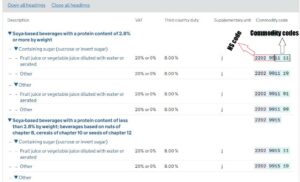

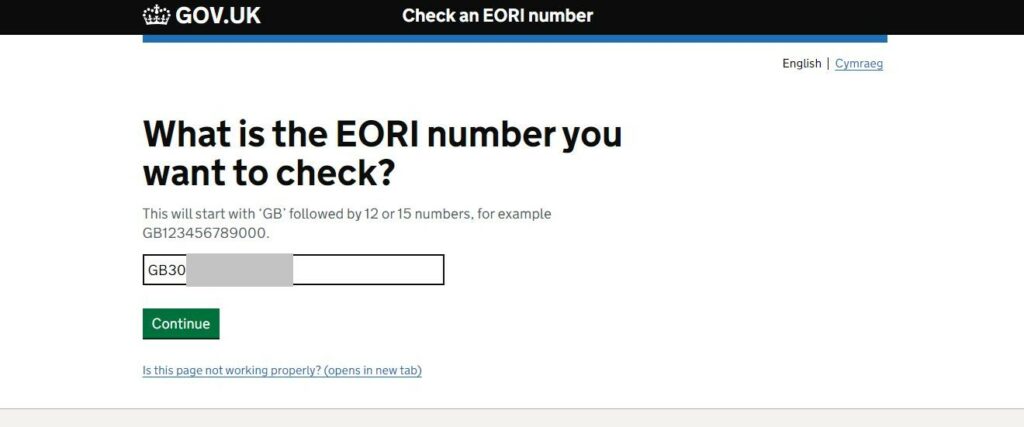

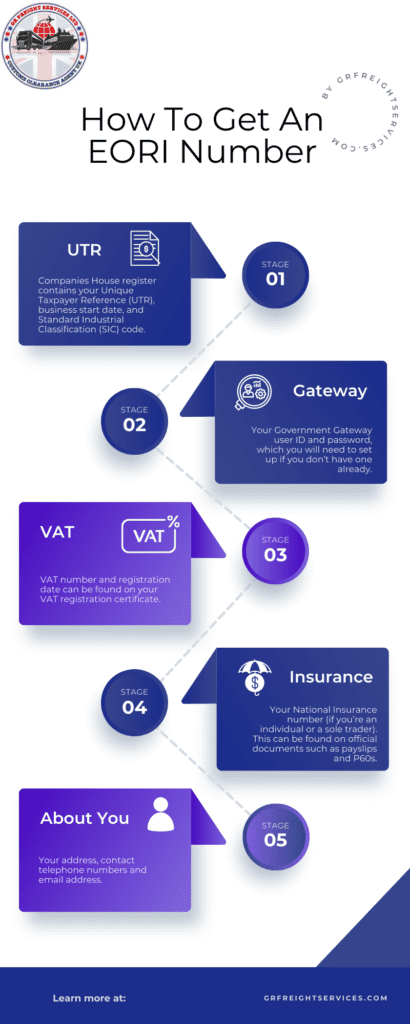

Customs Regulation for Fruit and Vegetables:

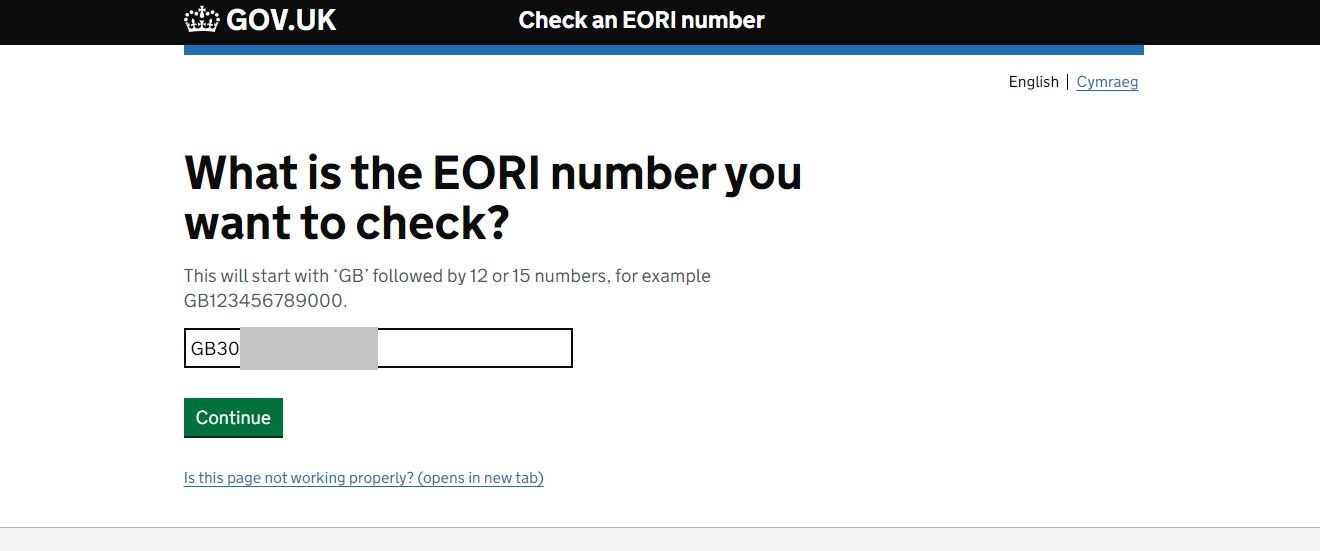

As with any import business, it’s important to comply with UK customs regulations when importing mangoes from Pakistan. This includes paying the appropriate duties and taxes, providing accurate labeling and packaging information, and ensuring that your shipment meets all required standards.

To avoid customs delays or issues, hire a professional customs broker who can assist you with the necessary procedures and documentation. This will help to ensure a smooth and hassle-free import process.

Once your mangoes have cleared customs and arrived in the UK, it’s time to savor these juicy fruits! There are endless ways to enjoy Pakistani mangoes – from simply eating them as a sweet snack to incorporating them into delicious dishes like mango lassi, chutneys, and curries.

Conclusion:

In conclusion, importing mangoes from Pakistan to the UK proves to be a profitable venture, offering consumers access to high-quality and delectable fruits. However, success in this endeavor hinges on a comprehensive understanding of the associated processes, laws, and regulations. This is vital for effectively managing an import business. Through meticulous planning and establishing relationships with reliable suppliers, one can introduce these tropical delights into the UK market, meeting the rising demand for Pakistani mangoes.