Ultimate Guide: Import RV or Motor Caravans To UK

Recreational vehicles (RVs), commonly known as motorhomes, have revolutionized the way we explore and enjoy the great outdoors. These self-contained traveling homes offer the freedom to roam the country’s highways and byways while carrying the comforts of home.

With so much popularity in United States, it’s no wonder that the RV industry has been growing rapidly. More and more people are choosing to invest in an RV, whether it’s for weekend getaways or full-time living. Europe and Australia also have a growing RV culture, making it a global phenomenon.

Importing RV To UK:

Motor caravans, popularly known as RVs in the UK, have been on the rise for several years. With its diverse landscape and stunning countryside, the United Kingdom is a dream destination for RV enthusiasts. But for those unfamiliar with the process, importing an RV to the UK can seem like a daunting task.

Choose the right RV:

When importing an RV to the UK, the first important step is selecting the right vehicle. From Class A, B, and C motorhomes to travel trailers and campervans, there are various options to choose from. Prioritize your needs and preferences before finalizing your decision. Consider factors such as size, budget, and amenities when making your choice.

Select a manufacturer:

Once you have decided on the type of RV, it’s important to select a reputable manufacturer. This is especially important when importing from other countries as it ensures that the vehicle meets UK safety and emission standards. Look for manufacturers that have experience in exporting RVs to Europe or specifically to the UK.

Check import regulations:

Importing an RV to the UK requires compliance with certain regulations and laws. You have to inform HM Revenue and Customs (HMRC) and pay any necessary taxes or duties. Also, ensure that your vehicle meets all the safety and emission standards set by the Driver and Vehicle Standards Agency (DVSA).

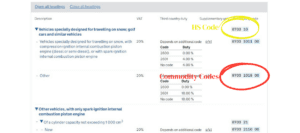

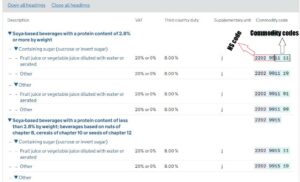

Duty:

The import duty for motorhomes or RVs depends on various factors such as the type of vehicle, its age, and its value. Generally, duty rates range from 0% to 10% of the total cost.

VAT:

You have to pay 20% value-added tax (VAT) on the total cost of your RV, which includes the purchase price and any shipping or insurance fees. However, if you are moving to the UK from another EU country, you may be exempt from paying VAT.

Shipping and transportation:

Once you have completed all the necessary paperwork and paid any applicable taxes and duties, it’s time to ship your RV to the UK. We recommend you to get helped from best freight forwarding company which can handle all aspects of transportation and provide proper insurance coverage.

If you are importing the RV from a faraway destination, consider using sea freight for a more cost-effective option.

Hire a broker:

To simplify the process of importing an RV to the UK, it is advisable to hire a broker who specializes in vehicle imports. Brokers can assist with completing paperwork and navigating the various regulations and laws involved in RV importation. They can also provide valuable advice on choosing the right shipping method and handling any unexpected issues that may arise during transportation.

Get your RV registered:

After your RV has arrived in the UK, it’s time to get it registered and insured. You will need to apply for a Vehicle Import Pack from DVSA and undergo vehicle approval testing before you can register your RV with the Driver and Vehicle Licensing Agency (DVLA). It is also important to remember that all motorhomes must be fitted with a speedometer showing both miles and kilometers per hour.

Final Verdict:

Importing an RV to the UK may seem like a daunting task, but with careful planning and assistance from professionals, it can be a smooth process. Choosing the right vehicle, following all regulations, and hiring a broker are key steps in successfully importing an RV to the UK. So pack your bags and get ready to hit the road in your very own motor caravan in the beautiful country of United Kingdom.