Unlocking Trade Benefits with the EUR1 or EUR-MED Certificate

When you’re trading with EU or Mediterranean partner nations, you can save money on duties when using an EUR1 or EUR-MED certificate. While these certificates are not mandatory, they can significantly reduce your costs and make your exports more competitive in the international market.

What is EUR1 Certificate?

The EUR1 certificate is your gateway to accessing preferential duty rates on exports to countries with EU trade agreements. It’s important for documenting preferential trade between the UK and partner nations. This certificate is a privilege granted to EU partners, allowing them to trade goods within the EU at reduced or zero tariffs.

What is a EUR-MED certificate?

An EUR-MED certificate is a trade document used in countries where the Pan-Euro-Mediterranean convention applies. It’s similar to an EUR.1 document and helps to determine the rules of origin for raw materials and products. This certificate offers the same financial benefits as those provided to goods of preferential origin companies.

Members:

| Algeria | Egypt | Israel | Jordan |

| Libya | Morocco | Palestine | Syria |

| Türkiye | Bosnia-Herzegovina | Albania | Mauritania |

| Montenegro | Lebanon | Tunisia | Monaco |

Importance of these certificates:

Obtaining an EUR1/EUR-MED certificate is essential for businesses that export to countries that have a preferential trading agreement with the EU. It allows companies to claim preferential duty rates, which can significantly reduce costs and make their goods more competitive in the global market.

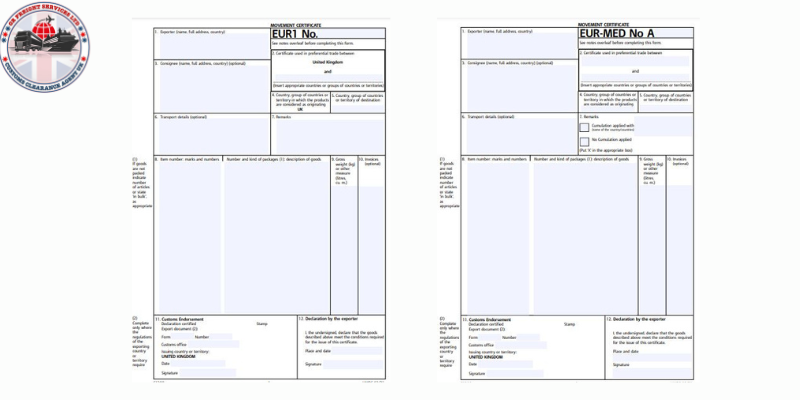

How to fill out the EUR1/EUR-MED certificate?

The HM Revenue & Customs (HMRC) provides detailed guidance on how to fill out the EUR1/EUR-MED certificate. You can check their website or consult with a customs agent for assistance.

How long does it take to get a EUR1 certificate?

The length of time it takes to obtain a EUR1/EUR-MED certificate may take 1-2 working days if the application is made online. However postal applications may processed and posted same day, but delivery times may vary depending on location and postal service.

How long is an EUR1 and EUR-MED valid for?

EUR1:

- The EUR1 certificate is valid for 4 – 12 after its date of issue, depending on the trade agreement.

- The documents proving the origin of goods must be kept for at least 3 years from the date of issue of the EUR1 certificate. [Source]

EUR-MED:

- The validity period for an EUR-MED certificate is usually 4 months after the date of issue.

- The origin documents must be kept for at least 3 years from the date of issuance of the EUR-MED certificate. [Source]

Sum Up:

In summary, the EUR1 and EUR-MED certificates are essential for businesses exporting to countries with EU trade agreements. These certificates provide preferential duty rates and can significantly reduce costs for companies. It is important to carefully fill out these certificates and keep all necessary documents for a certain period of time as required by customs regulations. We highly recommend consulting with a customs agent or checking the HMRC website for detailed guidance on obtaining and filling out these certificates.

Recent Blog

-

Importing Snails to the United Kingdom: A Guide for Individuals and Businesses

-

Say Goodbye to Customs Clearance Hassles with Tilbury's Professional Solutions

-

ATA Carnets Explained: Understanding the Basics and Benefits

-

Understanding EUR1 and EUR-MED Certificates: A Comprehensive Guide

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide