Understanding ATA Carnets: The Essential Guide for International Trade

Have you ever heard about without paying tax or duties while importing goods across borders? Well, it’s possible with the use of ATA Carnets. This document is recognized internationally and is accepted in over 80 countries, making it a valuable asset for businesses engaged in international trade.

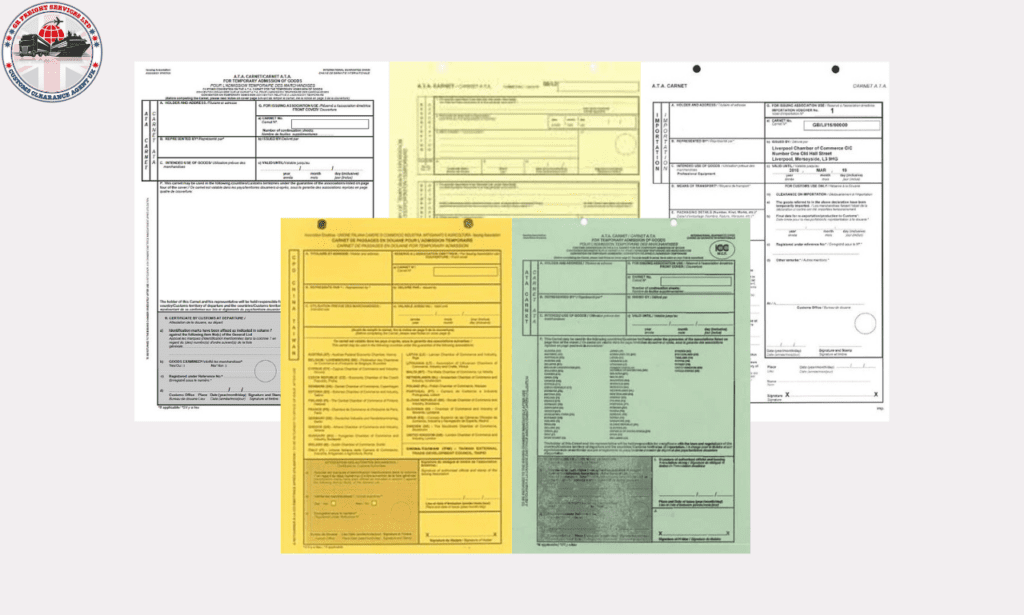

What is an ATA Carnet?

Admission Temporaire or Temporary Admission (ATA) Carnet is a document that allows the temporary importation of goods without the payment of duties and taxes. It serves as a customs document for the temporary admission of commercial samples, professional equipment, and goods for presentation or use at trade fairs, exhibitions, and similar events.

Who Issued ATA Carnets?

ATA Carnets are issued by National Chambers of Commerce or other organizations authorized by the World Chambers Federation (WCF). Meanwhile, United Kingdom National ATA Carnet Organisation (UKNATACO) is the designated national guaranteeing organization in the UK, responsible for issuing and administering ATA Carnets. Besides, UKNATACO local representatives across the country can assist in the preparation and submission of ATA Carnet applications.

Local Bodies to apply ATA Carnets:

- Aberdeen & Grampian Chamber of Commerce

- Birmingham Chamber of Commerce

- Bristol Chamber of Commerce

- Dorset Chamber of Commerce and Industry

- East Midlands Chamber

- Edinburgh Chamber of Commerce

- Glasgow Chamber of Commerce

- Greater Manchester Chamber of Commerce

- Hampshire Chamber of Commerce

- Liverpool Chamber of Commerce

- London Chamber of Commerce and Industry

- Northamptonshire Chamber of Commerce

- North East England Chamber of Commerce

- Northern Ireland Chamber of Commerce and Industry

- Norfolk Chambers of Commerce

- Thames Valley Chamber of Commerce

- West and North Yorkshire Chamber of Commerce

How Does It Work?

An ATA Carnet works as a passport for goods, allowing them to enter and exit countries without payment of duties or taxes. It simplifies the customs process by eliminating the need for multiple customs declarations for temporary imports. The Carnet is valid for one year and can be used for multiple trips within that timeframe.

Who Can Use ATA Carnets?

ATA Carnets are a valuable for various individuals and businesses, including exhibitors, salespeople, artists, athletes, TV crews, technicians, event participants, and travellers. This document is particularly advantageous for frequent business travelers as it offers time and cost savings.

How Long Does It Take to Get an ATA Carnet?

The processing time for an ATA Carnet varies depending on the issuing organization. We recommend to apply for the Carnet at least one week before your intended travel date to ensure timely delivery. Urgent requests can also be accommodated, but additional fees may apply.

How To Use ATA Carnets?

Whether you own the goods or not, ensure you use the goods correctly and re-export them from the visited country to avoid customs charges as a carnet holder. Don’t fret! As a carnet holder, it’s your responsibility to assure certain things:

- Pick the right Country: Your journey becomes smoother if the country you are visiting accepts ATA Carnets for your type of goods and end-use.

- Keep it Handy: Never forget to present your carnet to customs for stamping every time the goods enter or leave a country or customs territory. It’s like your passport in the world of trade!

- Voucher Removal: Let the customs remove the voucher at each usage. A small but crucial step.

- Change in Plans? Keep the Customs informed. If your goods are no longer eligible for use under the carnet you’ve purchased, give customs a heads up. Maybe you’ve decided to sell the goods?

- On-demand Show & Tell: Be prepared to showcase your carnet and the goods whenever customs ask for it.

Sum Up:

ATA Carnets is a great tool for businesses engaged in international trade. It offers convenience, cost and time savings while ensuring hassle-free temporary importation of goods. But achieving ata carnets requires proper awareness of the document so that you can reap its benefits to the fullest. That is why, a customs broker or freight forwarder can be a great resource for businesses looking to use ATA Carnets. They can guide you through the process and ensure compliance with customs regulations. So, make sure to explore this option and take advantage of this valuable document for your international trade needs.

Recent Blog

-

Importing Snails to the United Kingdom: A Guide for Individuals and Businesses

-

Say Goodbye to Customs Clearance Hassles with Tilbury's Professional Solutions

-

ATA Carnets Explained: Understanding the Basics and Benefits

-

Understanding EUR1 and EUR-MED Certificates: A Comprehensive Guide

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide