Navigating T1 Customs Clearance: All You Need to Understand

In the era of customs clearance business, the term “T1 customs” signifies a specific clearance procedure mandated for the importation of goods into select countries. This process necessitates meticulous attention to special processing and documentation for the successful entry of goods into the country. The T1 customs procedure is often time-intensive, demanding additional documentation such as invoices, packing lists, certificates of origin, and more.

Table of Contents

ToggleWhat is T1 Customs Clearance?

T1 customs clearance plays a pivotal role in the cross-border transportation of goods across various nations in the European Union, encompassing the UK. This procedure essentially operates as a transit mechanism, enabling seamless movement of goods within EU member territories, bypassing the need for formal customs clearance at each border crossing. Facilitating this process is the T1 document, functioning as a guarantee for potential customs duties and taxes if goods remain within the destination country.

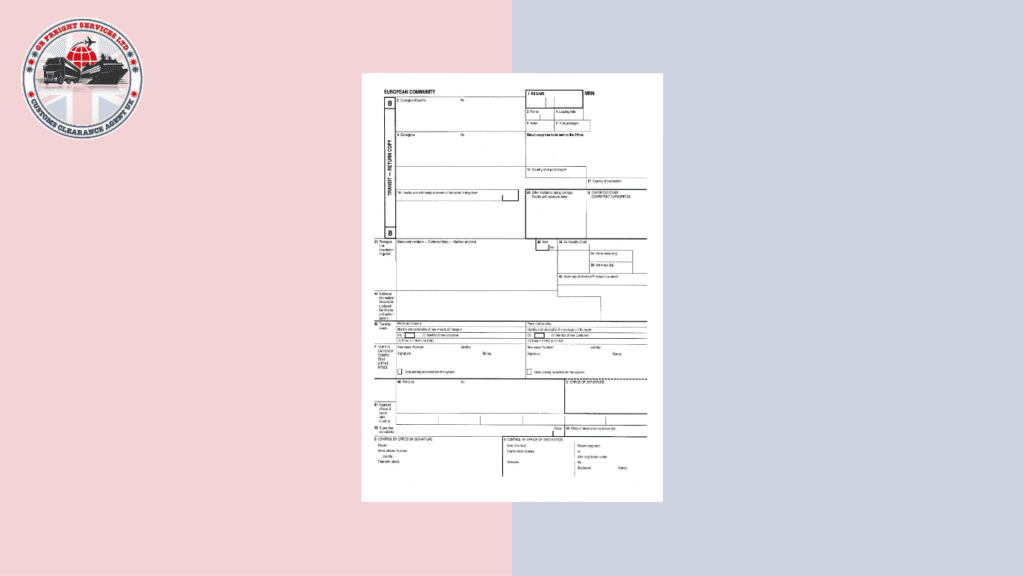

What is a T1 Customs Document?

The T1 customs document stands as a legally binding form integral to the importation process of goods. This document serves as official confirmation that the importer has duly settled any applicable taxes and duties associated with the imported goods. This authorization enables the goods to traverse EU borders without undergoing further scrutiny. The acquisition of the T1 Customs Document mandates interaction with an authorized customs official or representative prior to the shipment’s departure from its nation of origin.

Who Needs T1 Customs?

T1 Customs clearance is obligatory for anyone seeking to import goods and merchandise into the European Union, including the UK. This mandate encompasses both businesses importing goods for their operations and individuals aiming to bring personal belongings overseas. It’s noteworthy that not all nations necessitate T1 clearance; some might only require an ATA Carnet instead. Additionally, goods surpassing a certain value might demand supplementary paperwork and documentation before obtaining clearance to cross EU borders.

Who Produces A T1 Document?

Typically, the responsibility of creating a T1 document falls on a customs official or a representative, such as your dedicated customs broker. At GR Freight Service, we offer a comprehensive suite of custom clearance services, including the formulation of T1 documents. Our adept team ensures precise processing of your goods in adherence to all EU regulations, guaranteeing a hassle-free customs clearance for your shipment.

Can I Get T1 Document My Own?

While there are instances where obtaining a T1 document independently is feasible, engaging a seasoned professional custom broker or clearance service provider is strongly recommended. The intricacies of the process and the potential repercussions of errors, such as severe penalties and seizures, underline the prudence of entrusting this task to experts. Allow GR Freight Service to handle your customs necessities with the expertise they demand.

How Long Is T1 Valid For?

The validity of the T1 document extends to 8 – 9 days following its issuance date, contingent upon the destination country. If delivery of goods doesn’t occur within this timeframe, securing a new T1 customs document becomes imperative before the shipment can proceed. Meticulous planning and ensuring timely delivery of your shipment are crucial to preempt potential delays.

How Long Do I Have To Close Off A T1 Customs Form?

The closure of a T1 Customs Form necessitates completion within a specific window, typically around 14 days from the presentation of goods at the customs office upon entry. Failure to conclude the T1 closure within this duration renders the documents null and void. Should the need arise to exceed this timeframe, a valid reason for the delay must be furnished.

What Happens If T1 is Not Closed?

Neglecting the closure or cancellation of the T1 document within the stipulated timeframe entails the risk of incurring fines and penalties. In severe cases, non-compliant goods might face seizure and destruction for transgressing customs regulations or laws. To avert these adverse outcomes, it’s imperative to promptly conclude the T1 document as soon as your goods reach their intended destination.

Contact us:

Recent Blog

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide

-

The Definitive Guide to Incoterms for Global Trading Partners

-

The Importance of Harmonized System (HS) Codes in Global Trade

-

Ultimate Guide: Import Mangoes to UK from Pakistan | Mango Import Process Explained

-

Fast Customs Clearance Services at Harwich Port – Get Cleared Today!