Understanding Incoterms: The Essential Guide to International Trade Terms

In the complex and intricately connected world of global trade, Incoterms® stand as the foundation upon which international commerce negotiations rest. Established by the International Chamber of Commerce (ICC), these terms are pivotal in defining transactional roles, responsibilities, and risks between sellers and buyers, thus ensuring a uniform interpretation of common contractual clauses in international markets. With their precise definitions, Incoterms® facilitate clearer agreements, fostering confidence among trading partners across the globe.

What are Incoterms?

Incoterms® or International Commercial Terms are a set of standardized trade terms that are widely used in international transactions. These terms were first introduced by the ICC in 1936 and have since been updated periodically to reflect changes in the global trade landscape.

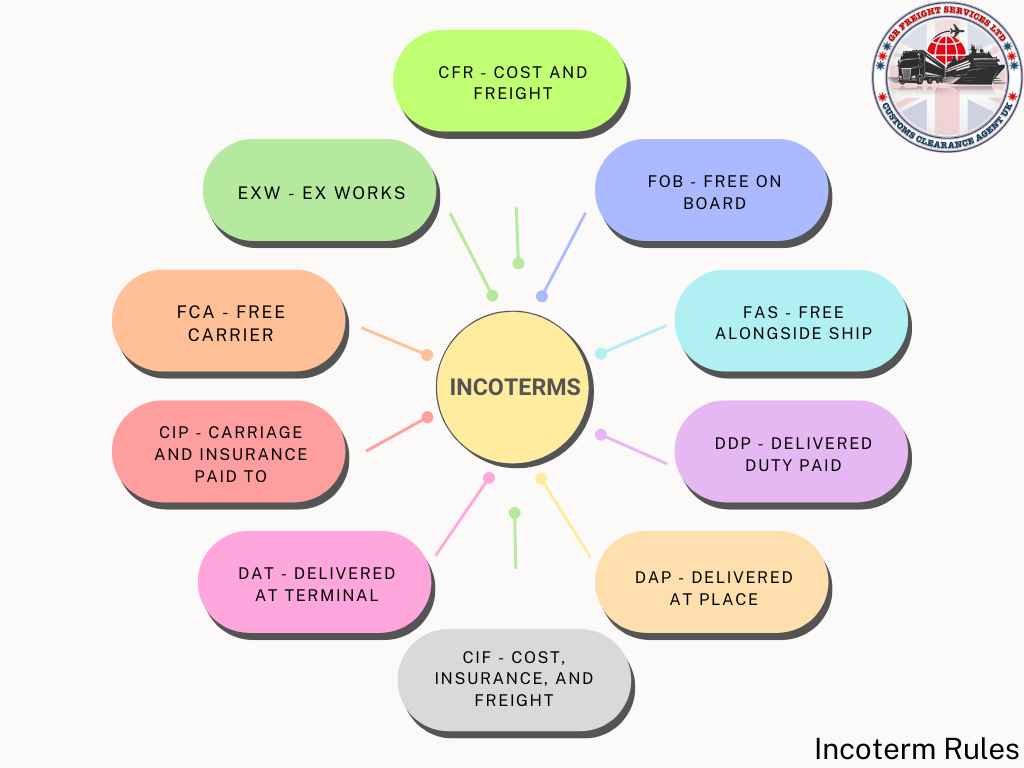

What are the 11 Incoterms rules?

The current version of Incoterms® includes eleven rules, each representing a specific set of responsibilities for buyers and sellers in international trade. These rules are divided into two categories: those applicable to any mode of transport and those specific to sea or inland waterway transport.

Rules applicable to any mode of transport:

- EXW – Ex Works

- FCA – Free Carrier

- CPT – Carriage Paid To

- CIP – Carriage and Insurance Paid To

- DAT – Delivered At Terminal

- DAP – Delivered At Place

- DDP – Delivered Duty Paid

Rules specific to sea or inland waterway transport:

- FAS – Free Alongside Ship

- FOB – Free On Board

- CFR – Cost and Freight

- CIF – Cost, Insurance, and Freight

These rules have been carefully designed to address the various stages of international trade, from packaging and labeling to customs clearance and delivery. By using Incoterms®, parties involved in a transaction can have a shared understanding of their roles and responsibilities, reducing the risk of misunderstandings or disputes.

Most common rules:

All the rules under Incoterms® have their unique features and applications, but five of them are commonly used in international trade: EXW, FOB, CIF, DAP and DDP.

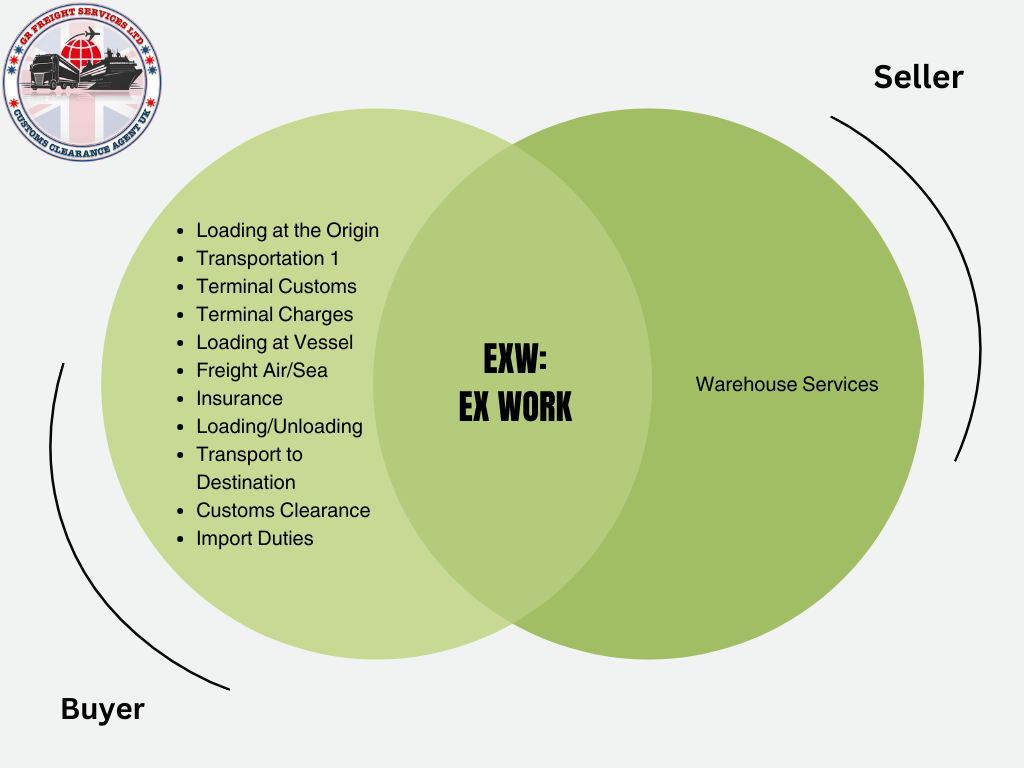

EXW: Ex Work

EXW is widely used by sellers who are not familiar with the customs procedures or duties of the buyer’s country. Under this rule, the seller is responsible for packaging and labeling the goods at their premises. The buyer is then responsible for all costs and risks associated with transporting the goods from the seller’s premises to their final destination.

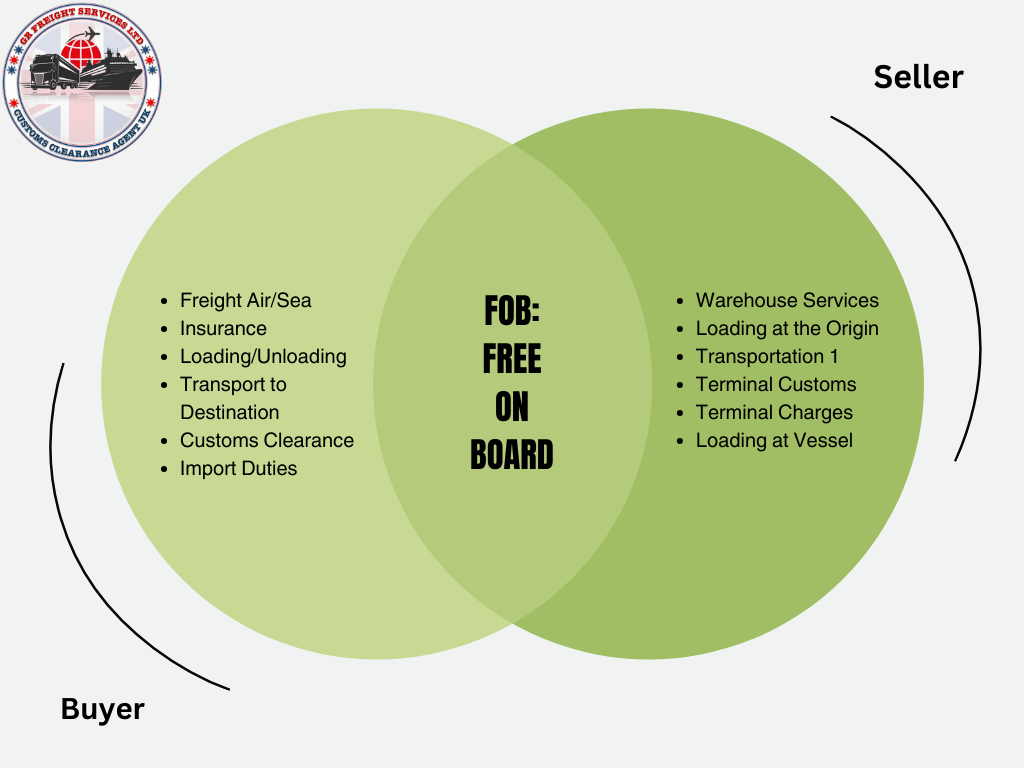

FOB: Free On Board

FOB is commonly used for goods transported by sea. In this rule, the seller is responsible for delivering the goods to the port of shipment and loading them onto the vessel. Once loaded, the risk transfers to the buyer who is responsible for all costs associated with transportation and insurance until the goods reach their destination.

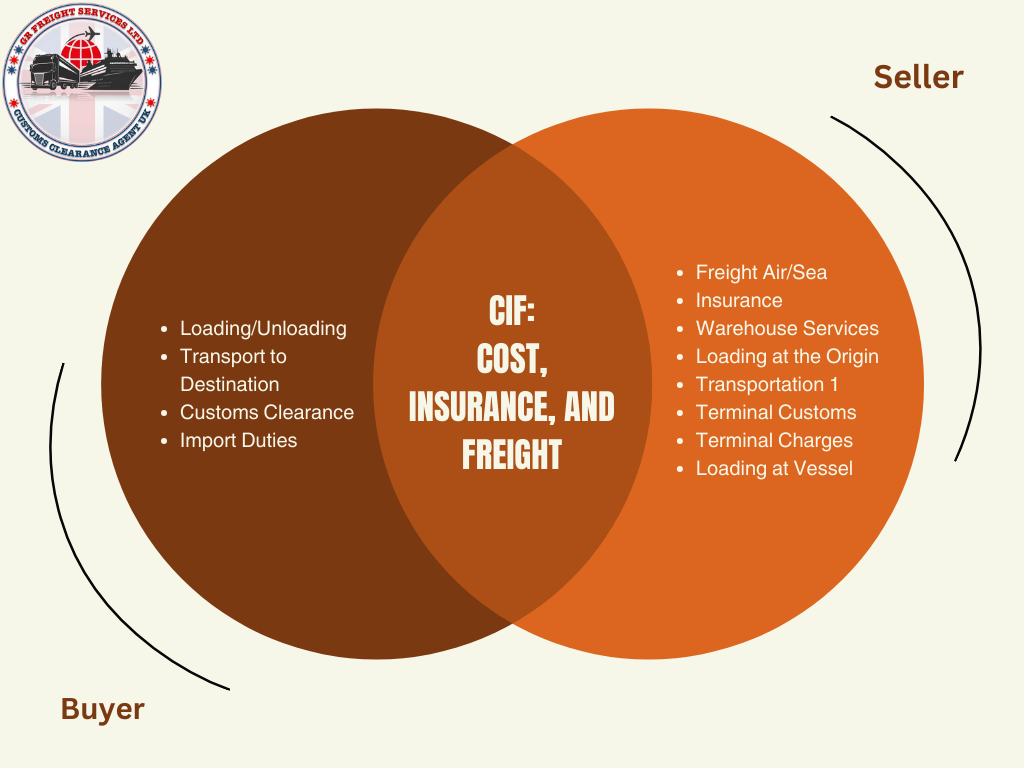

CIF: Cost, Insurance, and Freight

Other source for sea freight is the CIF rule. Here, the seller takes on more responsibilities than in FOB as they are also responsible for insuring the goods until they reach their destination port. However, once the goods have been loaded onto the vessel, the risk transfers to the buyer.

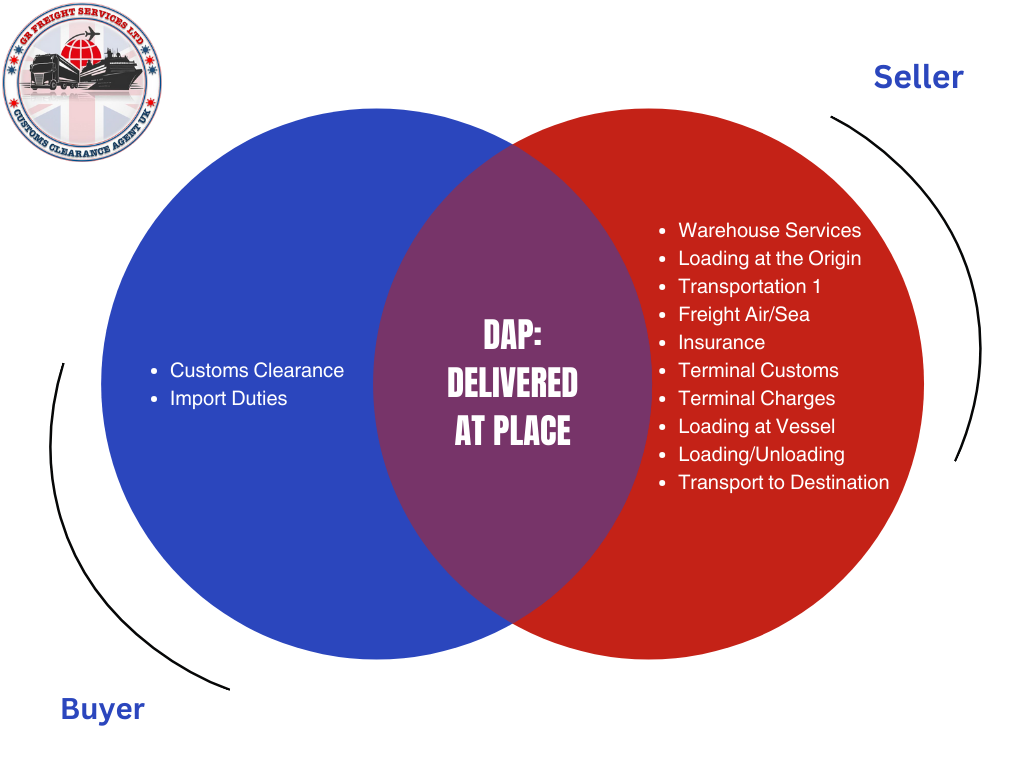

DAP: Delivered At Place

DAP is one of the most versatile rules under Incoterms® as it can be used for any mode of transport. Under this rule, the seller is responsible for delivering the goods to a named place and paying all costs until they are unloaded at that location. The buyer then takes on responsibility for unloading and subsequent transportation costs.

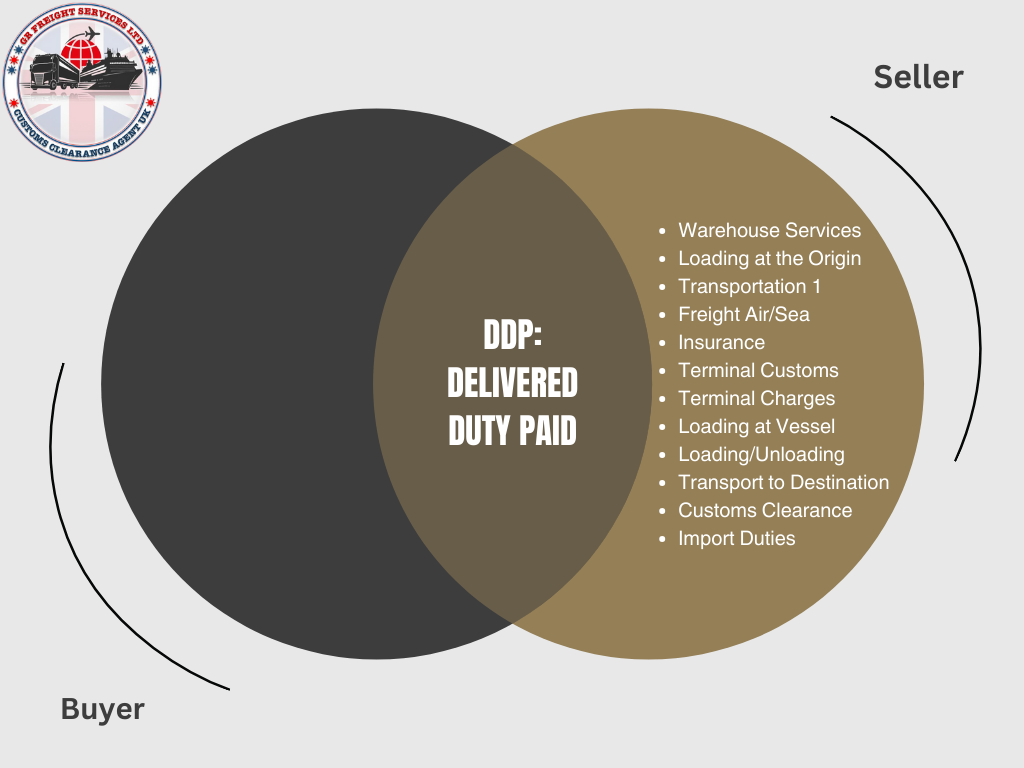

DDP: Delivered Duty Paid

DDP is the most comprehensive rule under Incoterms® as it places all responsibility, including the payment of any applicable duties or taxes, on the seller. The seller is responsible for delivering the goods to a named place in the buyer’s country and taking care of all costs associated with getting them there.

Sum Up:

If we say Incoterms® have revolutionized the world of global trade, it would not be an overstatement. These rules have brought much-needed clarity and consistency to international transactions, making them easier to understand and execute for all parties involved. But still you need any kind of clarification, we encourage you to consult our international trade experts.

Recent Blog

-

ATA Carnets Explained: Understanding the Basics and Benefits

-

Understanding EUR1 and EUR-MED Certificates: A Comprehensive Guide

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide

-

The Definitive Guide to Incoterms for Global Trading Partners

-

The Importance of Harmonized System (HS) Codes in Global Trade