Commercial Invoices | What it is and Why it's Important?

In the complex world of international trade, the commercial invoice operates as the passport for your goods. This document carries vital information about the sender, recipient, and the merchandise, making its meticulous preparation imperative. Without a well-prepared commercial invoice, your shipment can quickly become a casualty of customs clearance, causing costly delays and potential legal complications.

Table of Contents

ToggleWhat is a Commercial Invoice?

A commercial invoice is a crucial document in international trade transactions, serving as a comprehensive record of the transaction between the buyer and the seller. It provides essential information about the goods being shipped, acting as proof of their value and nature. This, in turn, expedites customs clearance and import/export procedures.

Who is Responsible for the Commercial Invoice?

Typically, the responsibility for preparing the commercial invoice falls on the exporter or seller. Accurate documentation of goods, including quantities, unit prices, and total value, is essential. Ensuring alignment between the commercial invoice details and the shipment is critical to avoiding delays or discrepancies during customs clearance.

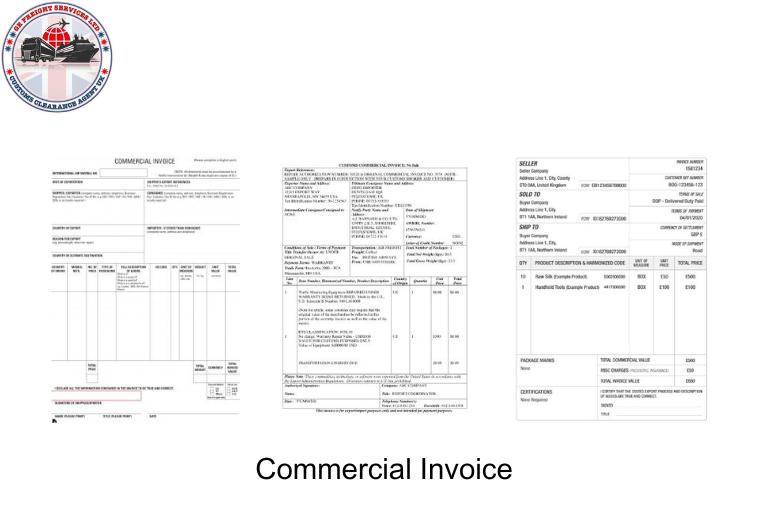

Essential Components of a Commercial Invoice

A well-prepared commercial invoice should encompass the following key elements:

- Sender and Recipient Information: Clearly state names, addresses, contact details, and relevant identification numbers of the exporter and importer.

- Itemized List of Goods: Provide a detailed description, including names, quantities, and necessary product codes or identifiers.

- Quantity, Weight, and Unit Prices: Specify measurements for each item to facilitate accurate valuation.

- Total Value and Currency: Calculate the total value, inclusive of taxes or discounts, and specify the transaction currency.

Commercial Invoice and VAT:

It’s crucial to differentiate between a commercial invoice and a VAT invoice. While a commercial invoice serves customs purposes, a VAT invoice is for domestic transactions, including additional details for tax compliance within a specific country.

Can a Commercial Invoice Be Used for Payment?

Although primarily a customs document, a commercial invoice can also serve payment purposes. Buyers may rely on it for payments, as it outlines agreed-upon terms, payment methods, and the total amount due.

Shipping Documents and Commercial Invoices:

In most cases, commercial invoices are not required for shipping documents or non-commercial items. However, verifying specific destination country requirements is recommended, consulting with customs experts to ensure compliance.

Seek Expert Customs Advice:

Navigating international trade complexities can be daunting. For inquiries or guidance on commercial invoices and customs requirements, reach out to customs brokers or trade experts. Their expertise ensures smooth customs clearance and compliance with regulations.

Remember, meticulous commercial invoices are paramount for successful international trade. Understanding key elements and legal requirements streamlines customs processes, allowing you to focus on global business growth.

Contact Us:

Recent Blog

-

Say Goodbye to Customs Clearance Hassles with Tilbury's Professional Solutions

-

ATA Carnets Explained: Understanding the Basics and Benefits

-

Understanding EUR1 and EUR-MED Certificates: A Comprehensive Guide

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide

-

The Definitive Guide to Incoterms for Global Trading Partners