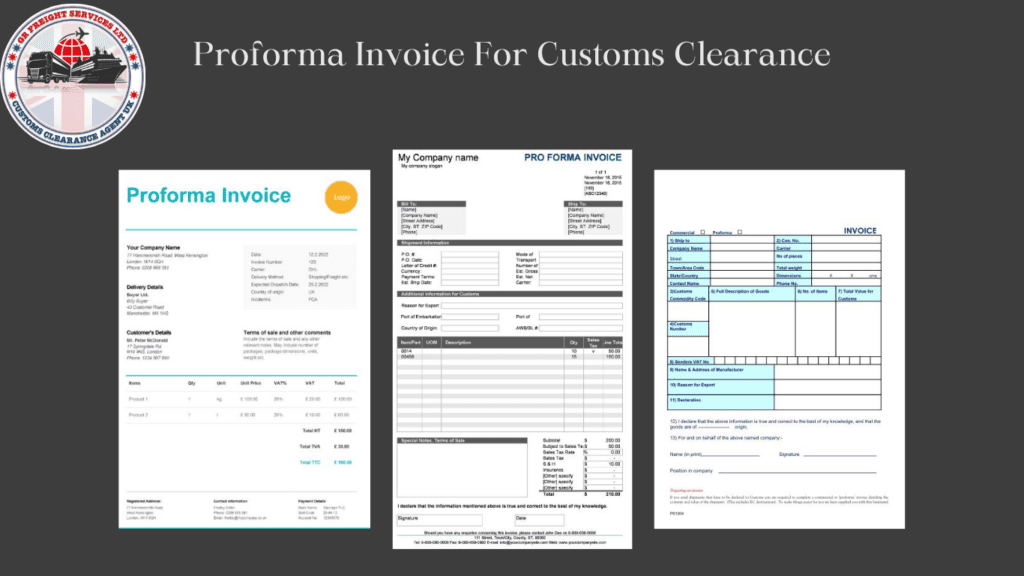

Pro-forma Invoice for Customs Clearance

When importing goods into the United Kingdom, navigating the customs clearance process involves multiple steps and documentation. One pivotal document in this process is the proforma invoice, playing a crucial role in accurately assessing the value of imported goods and determining applicable duties or taxes.

Table of Contents

ToggleWhat is a Proforma Invoice?

A proforma invoice serves as a provisional commercial document outlining the specifics of an international trade transaction between a supplier and a buyer. Issued by the supplier, it stands as an agreement on the terms of the sale, encompassing details such as goods description, value, and transaction-relevant information.

Who Requires a Proforma Invoice?

Primarily utilized in international trade transactions, especially during the import of goods, the proforma invoice is vital for both the supplier and buyer. It stands as concrete proof of their agreement.

How important is the Proforma Invoice in UK Customs Clearance?

The proforma invoice holds considerable importance in UK Customs Clearance. It aids customs officials in correctly classifying and valuing goods, directly influencing the owed duties and taxes.

Moreover, it functions as a contractual agreement between the buyer and seller. The signed document signifies agreement on payment terms and the provision of all necessary documents for clearance.

Facilitating seamless customs procedures, the proforma invoice furnishes detailed information about the goods—country of origin, description, quantity, and value. This information is instrumental in determining any applicable restrictions or licenses for importing.

Additionally, the proforma invoice acts as a reference for customs officials to verify if the actual invoice aligns with the values declared in it. Businesses must ensure accuracy to avoid delays, extra costs, or penalties.

Can a Proforma Invoice Account for VAT?

No, a proforma invoice cannot account for VAT. According to the UK VAT Act 1994, section 25, entitlement to input tax necessitates a valid VAT invoice for goods or services received for business purposes. Thus, only an official VAT invoice allows the claiming of input tax on imported goods.

Can POAO be brought in as a personal import?

In general, personal imports of POAO are restricted due to the lack of expertise and resources for ensuring compliance with UK regulations. Exceptions exist for small quantities of specific POAO products, such as meat and dairy from EU member states, which still must adhere to guidelines and undergo checks at Border Inspection Posts (BIP).

Additional Tips for Creating a Proforma Invoice:

When creating a Proforma Invoice, it is important to include all necessary information and ensure accuracy. This includes details such as:

- Names and addresses of the buyer and seller

- Description and quantity of goods being imported

- Country of origin and HS codes

- Price per unit and total value of goods

- Incoterms (international trade terms)

- Payment terms

- Shipping and handling information

- Any additional charges or fees (e.g. insurance, taxes, etc.)

It is also recommended to include a statement on the Proforma Invoice stating that it is not a legal invoice and is for customs purposes only.

Need Some Help:

Navigating through the customs clearance process can be a daunting and time-consuming task, especially for businesses that are new to international trade. That’s why it is highly recommended to hire an experienced customs broker or freight forwarder who can assist with all aspects of UK customs clearance, including the preparation and submission of the Proforma Invoice.

Contact Us:

Recent Blog

-

Importing Snails to the United Kingdom: A Guide for Individuals and Businesses

-

Say Goodbye to Customs Clearance Hassles with Tilbury's Professional Solutions

-

ATA Carnets Explained: Understanding the Basics and Benefits

-

Understanding EUR1 and EUR-MED Certificates: A Comprehensive Guide

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide