Import Royal Enfield to the UK: Complete Guide & Tips

Royal Enfield has cemented its reputation for producing resilient and classic motorcycles. Revered for models like the Bullet, Classic, and Interceptor, the company merges traditional aesthetics with modern technology, creating bikes with timeless appeal that resonate with both purists and modern-day adventurers. These motorbikes are designed to survive harsh conditions and challenge roads less traveled, which makes them perfect for bikers who crave adventure on two wheels.

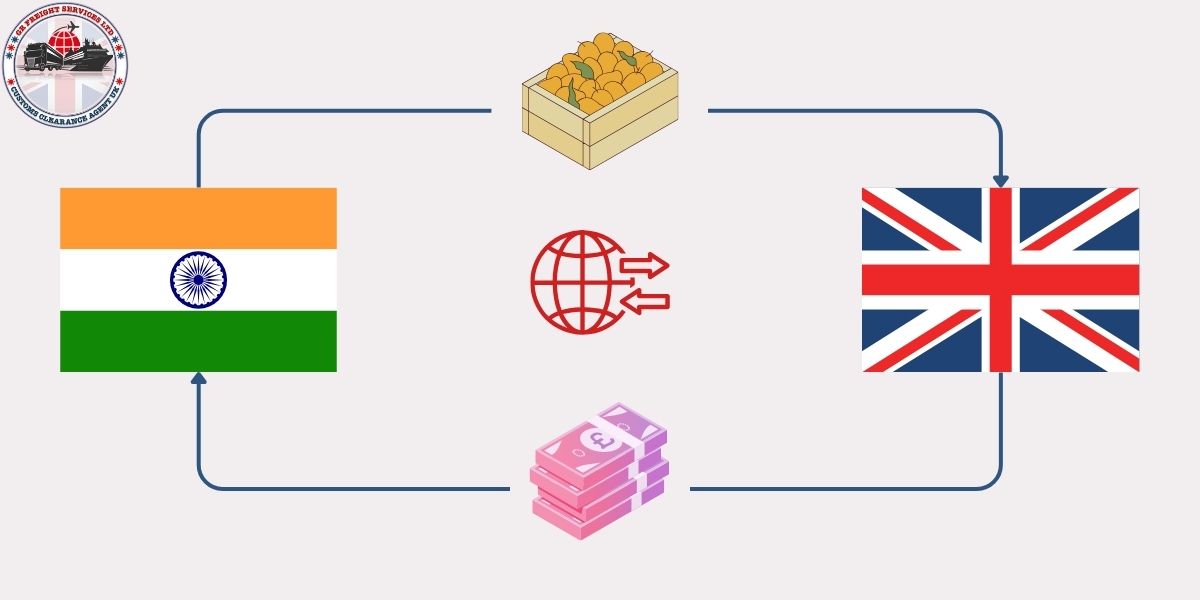

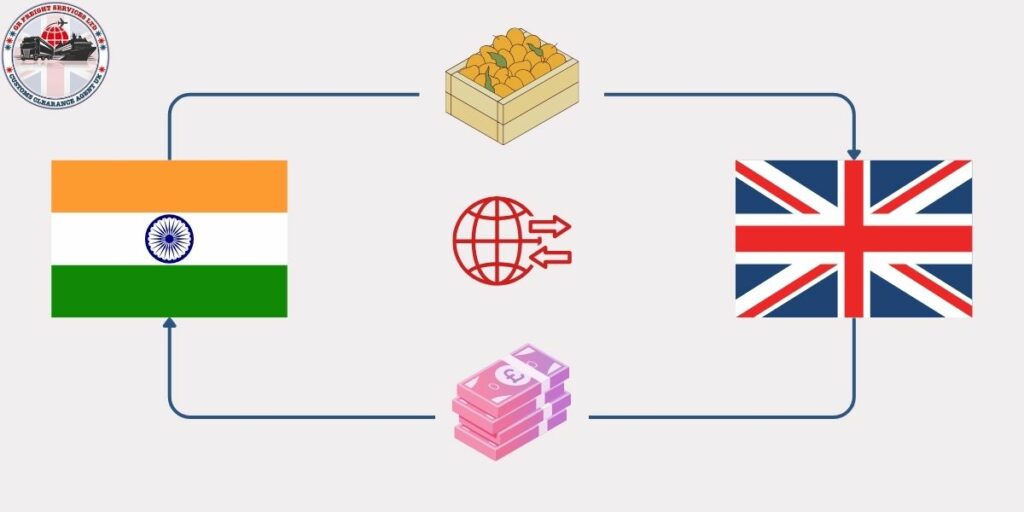

When it comes to import Royal Enfield in UK, the options are plenty. The brand has been steadily growing in popularity among UK riders, with more and more dealerships popping up across the country. But if you want to buy limited edition or customized models, importing from the company’s home country of India may be your best bet.

Import Royal Enfield To United Kingdom:

When decided to import a motorcycle from another country, it’s essential to research the process and requirements beforehand. In the case of Royal Enfield motorcycles, there are specific steps that need to be followed when importing into the United Kingdom.

Here are the necessary steps to import a Royal Enfield motorcycle into the United Kingdom.

Check if your bike complies with UK regulations:

Before starting the process of importing your motorcycle, it’s essential to ensure that it complies with the UK regulations. The most important aspect is to check if your motorcycle meets emission standards set by Transportation Department (DfT). If it does not, the vehicle will need to undergo modifications before being approved for import.

Register your motorcycle with the DVLA:

All vehicles imported into the United Kingdom must be registered with the Driver and Vehicle Licensing Agency (DVLA). This includes Royal Enfield motorcycles. You can either do this in person by visiting a local DVLA office or online via their website. The process requires you to provide the necessary documentation and pay a registration fee.

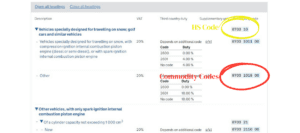

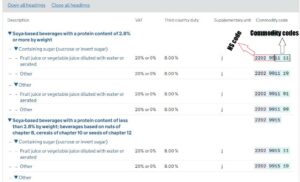

Pay Customs Duty:

To import your motorcycle into the United Kingdom, you’ll need to pay customs duty. This is calculated based on the value of your motorcycle, including shipping costs. Once paid, customs will issue a clearance certificate for your vehicle.

Arrange delivery of your motorcycle:

After completing the necessary steps, you will need to arrange for your motorcycle’s delivery from the country of origin to the United Kingdom. This can be done through a shipping company or by hiring a specialist motorcycle courier.

Pay VAT:

Upon arrival in the UK, your motorcycle will be subject to Value Added Tax (VAT). The standard rate is 20% and is calculated based on the total cost of your motorcycle, including customs duty and shipping.

Get your vehicle inspected by the DVLA:

Once your motorcycle has arrived in the UK, you’ll need to get it inspected by the DVLA before it can be legally driven on UK roads. This is an important step as it ensures that your vehicle meets all necessary safety standards.

Obtain UK insurance:

Before your motorcycle can be registered and driven on UK roads, you’ll need to obtain UK insurance. This is a legal requirement and can easily be done by contacting an insurance provider or broker.

Complete vehicle registration:

The final step in importing your Royal Enfield motorcycle to the United Kingdom is completing vehicle registration with the DVLA. This includes providing proof of ownership, valid insurance, and paying a registration fee.

It’s important to note that there may be additional steps or requirements depending on the country of origin for your Royal Enfield motorcycle. It’s recommended to research these specific requirements before beginning the importing process.

Please Note:

Motorcycles models differ from one country to another due to the different statutory norms. For instance, Indian motorcycle models will not pass a Ministry of Transport (MOT) test in the UK, and hence cannot be registered there. When importing a bike into the UK, it is important to ensure it complies with the Whole Vehicle Type Approval (WVTA). All models not previously imported into the UK must have a WVTA, complete with a VIN plate and a Certificate of Conformity from Royal Enfield. Therefore, if you’re considering getting a bike from outside the UK, it’s important to ensure that it meets the stated UK import policies or hire a freight forwarder to avoid complications down the line.