Customs Broker or Customs Agent: Which is better & why?

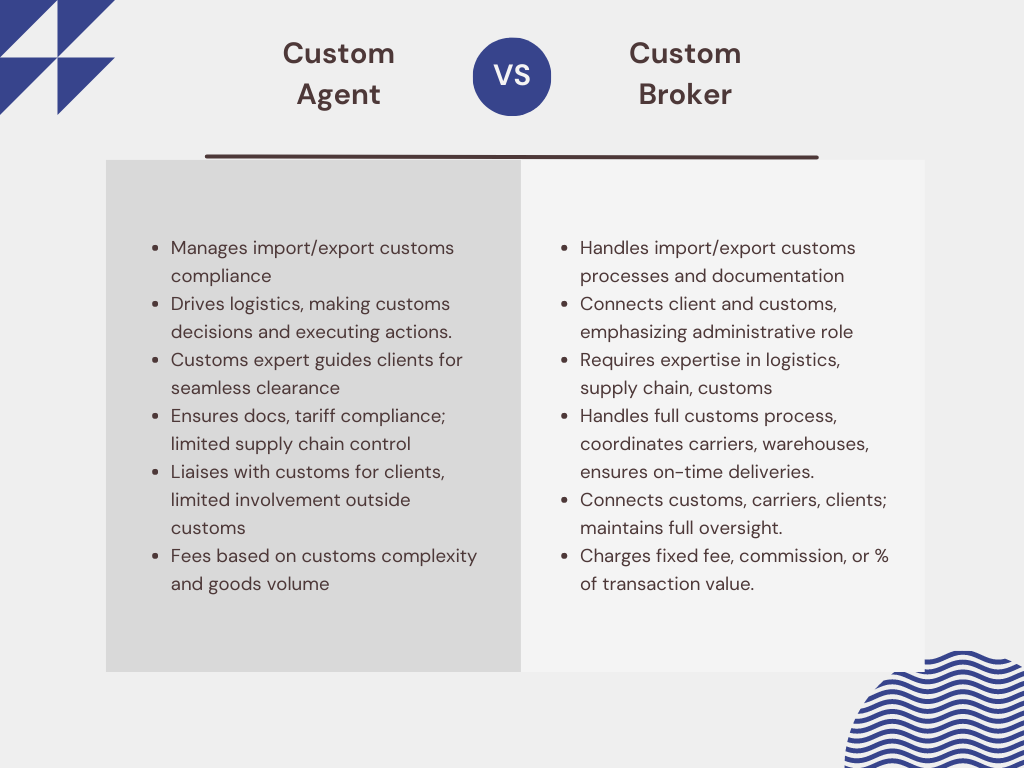

A Customs Broker and a Customs Agent, while both integral in the international trade sector, fulfil distinct roles. Customs brokers are responsible for facilitating the movement of goods and ensuring compliance with customs regulations, whereas customs agents represent importers and exporters during the clearance process.

Table of Contents

ToggleWhat is a Custom Broker?

Customs brokers stand as qualified specialists specializing in aiding individuals and businesses in navigating the complexities of international trade regulations. Their responsibilities encompass not only furnishing advisory services concerning the multitude of taxes, duties, tariffs, and other regulatory prerequisites linked to the import or export of goods but also extending assistance in securing permits and licenses for commodities necessitating special authorization for international movement. Additionally, customs brokers shoulder the responsibility of submitting customs declarations and other pertinent documentation on behalf of their clientele.

What is a Customs Agent?

Customs agents operate as government employees situated within the import/export division of national customs agencies. Their principal duty entails supervising cross-border trade operations to ensure that commodities entering or departing the nation align harmoniously with all applicable laws, regulations, and procedures. Their tasks encompass scrutinizing shipments, levying taxes and duties, and forestalling illicit smuggling endeavors.

What is the Work of Custom Broker in UK?

Within the United Kingdom, a customs broker shoulders the responsibility of assisting businesses and individuals in adhering to pivotal laws pertinent to international trade. Their advisory purview spans across areas such as tariffs, duty rates, VAT regulations, product classification, custom clearances, and a plethora of other subjects intertwined with the import/export of goods.

Furthermore, they may facilitate the compilation and submission of all requisite paperwork and documentation to ensure the seamless clearance of shipments. Customs brokers also possess the capability to file customs declarations, oversee freight forwarding processes, and solicit special permits or licenses when necessitated. Through a close collaboration with their clients, customs brokers streamline the import/export continuum, guaranteeing timely deliveries devoid of legal entanglements.

Why Do I Need A Broker For Customs?

For importers and exporters, enlisting the services of a customs broker assumes paramount significance in guaranteeing the appropriate clearance of goods for transit and commercialization. Customs brokers bring their expertise to bear upon matters concerning tariffs and duties, aiding in the meticulous preparation of requisite documents, and expediting the procedural aspects of obtaining indispensable permits. Their value becomes particularly pronounced when navigating interactions with governmental bodies or other authorities across diverse nations.

When seeking a reliable and fastest customs broker, GR Freight Services stands out as an exceptional choice. Our offerings encompass comprehensive services meticulously tailored to individual requisites. Rest assured, with us, your goods shall arrive punctually and devoid of any impediments. We urge you to reach out to us today, marking the commencement of our collaborative endeavors.

Can You be Your Own Customs Broker?

For certain individuals, opting for self-brokering can emerge as a viable alternative. If you possess an intimate familiarity with international trade regulations, customs statutes, and linguistic prerequisites prevalent in specific locales, you might find yourself adequately equipped to oversee the import/export process independently. However, it’s important to acknowledge that the absence of expert guidance or representation from a seasoned broker may inadvertently expose you to the risk of procedural errors in documentation or the imposition of avoidable taxes and duties.

Consequently, a substantial number of enterprises and individuals opt to entrust the task of customs brokering to professionals endowed with the requisite experience, resources, and specialized acumen necessary to ensure the unimpeded and secure import/export of goods.

Recent Blog

-

Say Goodbye to Customs Clearance Hassles with Tilbury's Professional Solutions

-

ATA Carnets Explained: Understanding the Basics and Benefits

-

Understanding EUR1 and EUR-MED Certificates: A Comprehensive Guide

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide

-

The Definitive Guide to Incoterms for Global Trading Partners