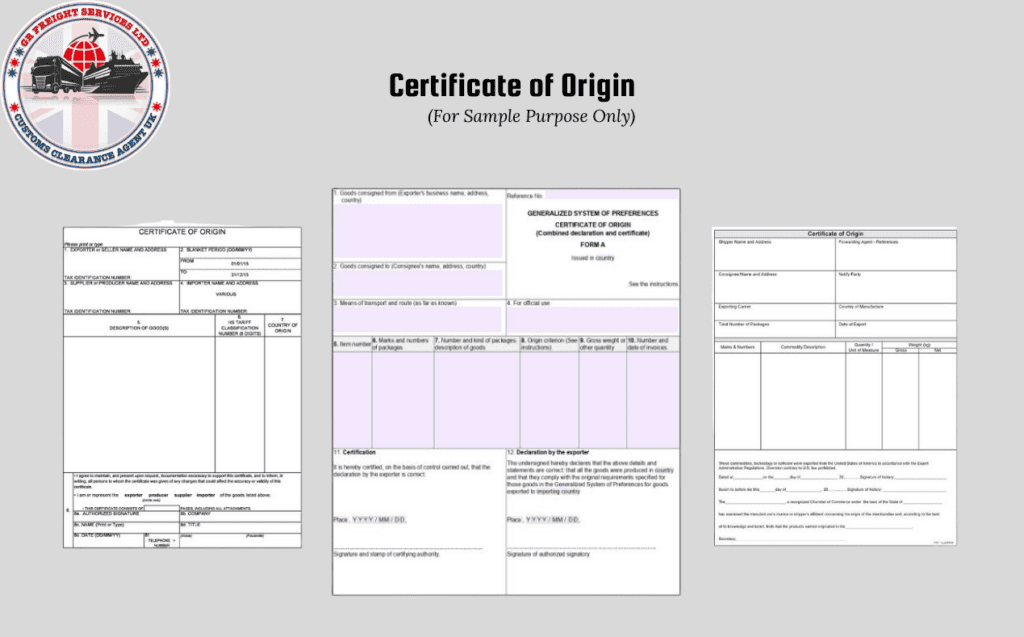

What is a Certificate of Origin (COO)?

A certificate of origin is a vital document that identifies the country where the shipped goods were produced. It serves as proof of a specific country’s origin, crucial for customs officials to determine eligibility for preferential tariff rates or trade agreements.

Why a Certificate of Origin is Necessary?

A certificate of origin is essential for both importers and exporters. For exporters, it establishes credibility and authenticity in the international market, enabling them to leverage trade agreements offering favorable tariff rates for goods from specific countries. Importers require it for customs clearance, ensuring compliance with trade regulations and restrictions.

In addition, a certificate of origin plays a crucial role in tracking and verifying cross-border movement, promoting fair trade practices, and preventing fraudulent activities like mislabeling or false claims of origin.

Who Needs a Certificate of Origin?

The certificate of origin is necessary for many international trade transactions, particularly in importer/exporter dealings. Contact your local chamber of commerce or customs broker for specific requirements in your region.

How to Obtain a Certificate of Origin (UK)?

To obtain a certificate of origin for goods exported from the UK, follow these steps:

- Determine if a certificate is needed based on the destination country and existing trade agreements.

- Gather necessary documents, including a commercial invoice and packing list.

- Apply through your local Chamber of Commerce or designated authority, submitting an application form and paying the required fee.

- Ensure accuracy in information to prevent delays in the certification process.

After submission, the Chamber of Commerce or designated authority will review and process the application. Once approved, a physical certificate will be issued, available for collection or delivery.

How much does a certificate of origin cost?

The cost varies by issuing organization, typically involving an application fee. Additional charges may apply for expedited services. Check with your local Chamber of Commerce or authority for specific costs in your region.

How long does it take to get a certificate of origin?

The certificate may take hours to days to obtain, depending on the issuing organization. Plan ahead to avoid delays in shipping.

Can I make my own certificate of origin?

It is not recommended to create your own certificate of origin as it may not be recognized or accepted by customs officials. Only certificates issued by authorized organizations or authorities are considered valid for international trade purposes.

Creating a fraudulent certificate of origin is also illegal and can result in penalties and legal consequences. It is always best to obtain a legitimate and verified certificate from the proper channels to ensure smooth and legal trade transactions.

Conclusion:

A certificate of origin is an important document for customs clearance and ensuring fair trade practices globally. Importers and exporters must understand the requirements, including documents, fees, and processing time, to facilitate legal and smooth trade transactions.

Contact Us:

Recent Blog

-

Say Goodbye to Customs Clearance Hassles with Tilbury's Professional Solutions

-

ATA Carnets Explained: Understanding the Basics and Benefits

-

Understanding EUR1 and EUR-MED Certificates: A Comprehensive Guide

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide

-

The Definitive Guide to Incoterms for Global Trading Partners