What is EORI Number? Why Do You Need EORI Number for Your Business?

An EORI Number (Economic Operators Registration and Identification) is a unique identification number assigned to businesses that trade goods or services with other countries in the European Union (EU). It is a required identifier for businesses to use when trading with EU countries. In this blog post, we will encounter the facts and importance of having an EORI Number.

Table of Contents

ToggleWhat is an EORI Number?

In international trade, companies are assigned an EORI number as part of their unique identification. It stands for Economic Operator Registration and Identification Number. It helps customs authorities identify, track, and monitor goods movement across national borders. An EORI Number is required to move goods into or out of the United Kingdom (UK).

In the UK, businesses can get an EORI Number by registering with HM Revenue & Customs (HMRC) and creating an EORI. A registration process generally takes between 1-2 weeks and requires documents such as passports, proof of residency, company registration certificates, and VAT registration numbers. Once you have submitted your application, HMRC will review it and issue an EORI Number to you.

Why Do I Need An EORI Number?

Every UK-based business that wants to trade with countries in the European Union (EU) needs an EORI Number. Without an EORI Number, it is difficult to move goods into or out of the EU. With an EORI Number, you will also be able to access customs procedures like suspension of duty and simplified declarations.

An EORI Number not only serves as proof of identity for EU trade purposes, but also for customs grants, notifications from HMRC, and other services from the UK government.

It is critical to note that an EORI Number is required for any UK-based business trading with countries in the EU. Without an EORI Number, it is difficult to move goods into or out of the UK.

Can I Import Without EORI Number?

You can only import personal goods into the European Union without an EORI number. However, if you are importing commercial goods (such as items for sale or business use), you must have an EORI number to do so.

Is EORI The Same As Tax ID Or VAT Number?

No, an Economic Operator Registration and Identification (EORI) number is not the same as a Tax ID or VAT Number. A Tax ID is a unique identification number assigned to an individual or business for tax filing purposes. A VAT Number, or Value Added Tax Number, is an identification number assigned to a business for the purpose of charging and collecting VAT from consumers.

Does An Individual Need An EORI Number?

Most of the agents can apply for an EORI Number. Agents are registered with the HMRC and have access to a valid EORI number that is necessary for them to move goods in and out of the EU. At GR Freight Services, we are registered with HMRC and have access to a valid EORI number that allows us to move goods freely in and out of the EU. We can also assist our customers in obtaining an EORI number if required.

Can You Use the Same EORI Number?

Yes, you can use the same EORI number to conduct customs operations in the United Kingdom. The number remains valid until your business ceases to exist and is the same across all EU countries. However, you must ensure that all information registered in the system is up to date and accurate.

What is the difference between EORI and XI EORI?

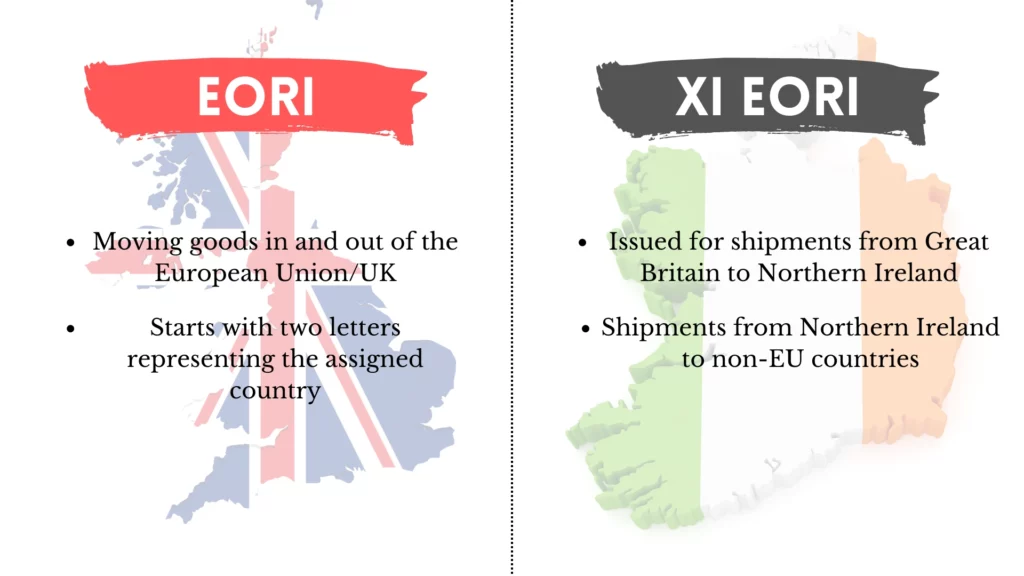

An EORI number is an identifying number that all economic operators must have if they want to move goods in and out of the European Union. All EORI numbers start with two letters that identify the country in which they were assigned, such as GB for Great Britain or FR for France.

XI EORI numbers, on the other hand, are a special type of EORI number issued specifically for shipments into Northern Ireland from Great Britain, shipments out of Northern Ireland to a non-EU country, declarations made in Northern Ireland and applications for customs decisions in Northern Ireland. XI EORI numbers differ from other types of EORI numbers because they always start with the letters “XI”, rather than two letters that identify the country. In other words, all economic operators who wish to move goods into and out of Northern Ireland from Great Britain must have an XI EORI number.

Recent Blog

-

Understanding Commodity Codes for Trading Success: A Comprehensive Guide

-

The Definitive Guide to Incoterms for Global Trading Partners

-

The Importance of Harmonized System (HS) Codes in Global Trade

-

Ultimate Guide: Import Mangoes to UK from Pakistan | Mango Import Process Explained

-

Fast Customs Clearance Services at Harwich Port – Get Cleared Today!